United States Gambling Revenue Hits Record $60.4 billion in 2022

The American Gaming Association (‘AGA’) has announced record commercial gaming revenue in the United States of $60.4 billion in 2022. This represents a 13.9 percent increase on 2021’s prior record figure of $53.0 billion.

AGA collects data from both the land-based and online sectors. Land-based gambling was still far the largest segment, with 80.5 percent of the United States’ total gambling revenue coming from land-based venues. As legalization continues to rollout, online sports betting and iGaming have shown strong growth, with the 19.5 percent online revenue being a new record high.

What’s the United States gambling revenue breakdown?

- Land-based casino: 84 million American adults, or 34 percent of the adult population, visited a casino in the past year—including new markets in Nebraska and Virginia. Table game revenue experienced a strong boost in demand, up 13.9 percent year-over-year, while slot machines showed steady 5.1 percent annual growth.

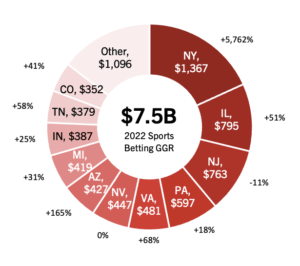

- Sports betting: In 2022, the continued growth of the legal market drove new records for handle ($93.2B) and sportsbook revenue ($7.5B). This growth was fueled in part by Kansas, which operationalized both retail and mobile sports wagering, and the launch of mobile sports betting in Louisiana, Maryland and New York.

- Online casino: Online casino revenue grew 35.2 percent year-over-year to $5.0 billion in the limited number of legal iGaming states.

What drove US Sports Betting growth?

Sports betting revenue growth was heavily driven by the launch of legal land-based betting in Kansas, and the addition of mobile and online wagering in Louisiana, Maryland and New York. As the below chart shows, all states except Nevada and New Jersey produced positive growth.

There’s still ample opportunity for the total addressable market to grow significantly. The three most populous states in America are yet to legalize, with sports wagering in Florida, sports betting in Texas and sports betting in California all still potentially in the pipeline. There’s also the tribe dominated state of Oklahoma which doesn’t yet have sports wagering, too.

The success of launches such as New York mobile sports betting will only add fuel to the fire as commercial operators continue to lobby for legalization in the aforementioned states.

Credit: AGA

Despite being substantially smaller in geography, the six active states (excluding Nevada) recorded revenue of $5.02 billion, up 35.2 percent on prior year. This was without new launches in any state, and goes to show the potential size of iGaming in the country.

All states where iGaming is legal set new records for revenue throughout 2022, and there’s a good chance other states will join in the legalization of online casino, too.